Advanced Nanodevice Fabrication in 2025: Transforming Electronics and Healthcare with Breakthrough Manufacturing. Explore the Technologies, Market Dynamics, and Future Outlook Shaping the Next Era of Nano-Enabled Devices. Executive Summary: Key Trends and Market Drivers in 2025 Market Size, Segmentation, and 2025–2030 Growth Forecasts Breakthrough Fabrication Techniques: From Atomic Layer Deposition […]

AR Gesture Recognition Systems 2025: Unleashing Next-Gen Interaction & 30% Market Growth

Augmented Reality Gesture Recognition Systems in 2025: Transforming Human-Device Interaction and Driving Explosive Market Expansion. Discover the Technologies, Trends, and Opportunities Shaping the Next Five Years. Executive Summary: Key Insights and 2025 Market Snapshot Market Size, Growth Rate, and Forecasts Through 2030 Core Technologies: Sensors, AI, and Computer Vision Innovations […]

Endoluminal Robotics for GI Surgery: 2025 Market Surge & Disruptive Innovations Ahead

Revolutionizing Gastrointestinal Surgery: How Endoluminal Robotics Will Transform Patient Outcomes and Market Dynamics in 2025 and Beyond. Explore the Next Era of Minimally Invasive GI Procedures. Executive Summary: Key Trends and Market Drivers in 2025 Technology Overview: Endoluminal Robotics Platforms and Capabilities Market Size and Growth Forecasts: 2025–2030 Competitive Landscape: […]

Genomic Fixed-X Allele Profiling: Surprising 2025 Breakthroughs & Billion-Dollar Forecasts Revealed

Table of Contents Executive Summary: Market Drivers and 2025 Outlook Fixed-X Allele Expression Profiling: Scientific Fundamentals and Technology Overview Key Players and Innovators: Company Strategies and Milestones Emerging Applications: From Oncology to Rare Disease Diagnostics Current Market Size, Segmentation, and Growth Projections (2025–2030) Breakthrough Technologies Shaping the Next 5 Years […]

2025 Subterranean Bat Ultrasound Tech: Market Booms, Breakthroughs & Top Players Revealed

Table of Contents Executive Summary: Key Insights & 2025 Highlights Market Size & Growth Projections Through 2030 Leading Manufacturers & Innovators (e.g., Wildlife Acoustics, Titley Scientific, batcon.org) Emerging Technologies: AI, IoT, and Real-Time Data Capture Application Trends: Conservation, Mining, and Urban Infrastructure Regulatory Landscape and Global Standards Supply Chain & […]

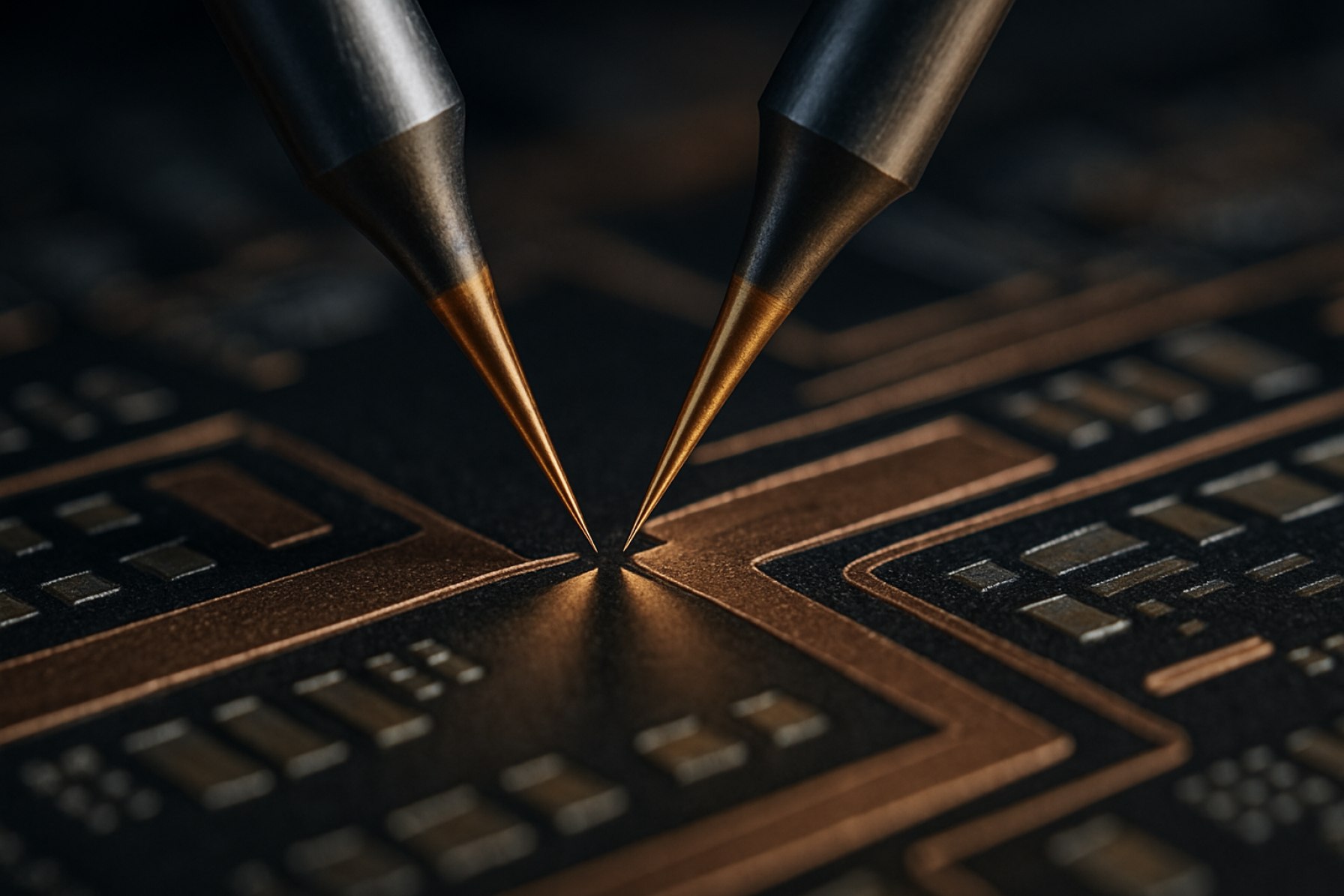

Angstrom-Scale Nanogap Tech: The 2025 Breakthrough That Will Reshape Electronics Forever

Table of Contents Executive Summary: 2025 and Beyond for Angstrom-Scale Nanogap Fabrication Market Landscape: Current Size, Growth, and 2029 Forecast Core Technologies: State-of-the-Art Nanogap Fabrication Methods Key Industry Players and Official Developments Emerging Applications: Quantum Computing, Biosensing, and Nanoelectronics Material Innovations and Manufacturing Challenges Intellectual Property and Regulatory Considerations Strategic […]

Whalebone Acoustic Tagging Tech in 2025–2029: The Breakthrough That’s Changing Marine Research Forever

Table of Contents Executive Summary: Key Findings and 2025–2029 Outlook Market Size & Growth Forecast: Whalebone Acoustic Tagging Technologies Latest Technological Innovations in Acoustic Tagging Systems Major Companies and Industry Stakeholders (e.g., wildlifecomputers.com, lotek.com, theladders.org) Regulatory and Ethical Considerations in Marine Tagging Applications: Conservation, Research, and Commercial Monitoring Challenges: Data […]

Why 2025 Will Redefine Vanishing Shearwave Velocity Imaging Systems: Surprising Forecasts, Breakthrough Tech, and Key Players to Watch in the Next 5 Years

Vanishing Shearwave Velocity Imaging: 2025 Market Shake-Up & Game-Changing Advances Revealed Table of Contents Executive Summary: 2025 Outlook for Vanishing Shearwave Velocity Imaging Introduction: Technology Fundamentals and Industry Definition Current Market Size, Segmentation, and Geographic Hotspots Key Manufacturers and Industry Organizations (e.g. siemens-healthineers.com, gehealthcare.com, ieee.org) Breakthrough Technologies: Next-Gen Algorithms, Hardware, […]

Sandalwood Distillation Apparatus Manufacturing: Market Dynamics, Technological Innovations, and Growth Outlook (2025–2030)

Table of Contents Executive Summary and Industry Overview Global Market Size, Trends, and Forecasts (2025–2030) Key Players and Competitive Landscape Raw Materials Sourcing and Regulatory Compliance Advancements in Distillation Technologies and Automation Sustainability: Eco-friendly Manufacturing and Waste Management Supply Chain and Distribution Channels Regional Analysis: Production Hotspots and Emerging Markets […]

The Oracle’s Ominous Forecast: A Market Storm on the Horizon?

Warren Buffett is stepping down as CEO of Berkshire Hathaway, but remains chairman and largest shareholder. Buffett anticipates a significant market downturn, stressing it as a regular, cyclical occurrence in financial markets. He advises staying calm amid market volatility, drawing on historical contexts like the Great Depression. Buffett emphasizes maintaining […]